Open Enrollment for Health Insurance: Choose Your Health Plan Wisely

Rich girl summer has come to an end, BUT open enrollment for health insurance is just getting started. Most states allow you to make changes to your health insurance policy by April 15, 2022. And to be honest, I find this to be one of the most important decisions you can make, yet a decision that people find to be very confusing, intricate, and tortuous.

I can talk about investing in the stock market all day, but investing in your health and the proper health insurance plan is important AF. People are too quick to choose the cheapest option for themselves because “they’re already healthy,” or “they’ve never had an emergency.”

When it comes to investing, I tell people not to focus on past performance. And I’m going to tell you the same thing for your health insurance. Don’t choose your health plan just because nothing has happened to you yet (god forbid).

Unpopular opinion: When it comes to choosing your health insurance plan, “I never go to the doctor” and “I’m young and healthy” don’t matter.

I stand by that. I was young and healthy and wound up with multiple chronic illnesses and a dislocated vertebra all in a matter of a couple months. Anything can happen. I am living proof that you can be healthy and still pay over $100,000 out-of-pocket even on a Platinum PPO Insurance. Ouch would be an understatement. Could you imagine if I chose a shit health plan based on my previous health history?

Not only is it important to choose the right plan for you, but by understanding your health insurance policy, you can save A LOT of money. You can also figure out what your plan covers 100% of for preventative care which you should be taking FULL ADVANTAGE of because health > wealth amirite? I am right.

I don’t look at the 100% covered preventative care items in your health insurance plan as something you get for free. I look at it as something you pay for so why not use it? You’d be surprised at what’s included and how imperative preventative health care really is.

Everyone’s health care plans are all very different.

Health care plans are so bamboozling that it is literally like trying to learn a new language backwards, upside down, and in cursive wingdings font.

Almost impossible.

So let’s keep it simple and start with some basic definitions, shall we?

Below are some definitions to know:

PPO (Preferred Provider Organization): A health plan with a larger network, meaning you typically have access to more doctors and hospitals to choose from.

EPO (Exclusive Provider Organization): A health plan offering a local network of doctors to choose from. Any care that is out-of-network will not be covered under this plan unless it is deemed emergency.

HMO (Health Maintenance Organization): A health plan with a local network of doctors to choose from. You would need to see your PCP (Primary Care Physician) first in order to get referrals to see specialists. My concern with an HMO is that sometimes it takes months to see your PCP, it then takes a long time to get a referral and have it checked by insurance, and then you have to wait months to see specialists. Want to see a neurologist? Might take your 3-6 months compared to being on a PPO plan.

In-network coverage: Choosing an in-network doctor typically means you will pay less out-of-pocket because participating health care providers have agreed on lower fees for health care.

Out-of-network coverage: Choosing an out-of-network doctor means you will pay more out-of-pocket because the doctor is not contracted with your insurance plan provider. Sometimes people choose out-of-network doctors when it is too challenging to get an appointment with an in-network doctor or there is a specific doctor that you want to see.

That was only round one of definitions, are you still with me?

Of course you are. Here’s round 2:

What is a deductible? Deductibles are set amounts of money you must spend on covered healthcare expenses BEFORE your health insurance plans begins to cover anything. I’ll go over how this works in an example (coming up shortly).

What are out-of-pocket maximums? The maximum limit you would need to pay out-of-pocket for healthcare services annually (not including the cost of your plan premium).

Generally, the lower the monthly premium, the more you would pay in out-of-pocket expenses before insurance starts to cover your bills.

What is coinsurance? The percentage of covered health care services you will pay AFTER you’ve met the deductible. For example, it could be 10% or 20% of the bill, and insurance would pay the rest. Coinsurance is something I pay attention to a lot. I prefer plans where I’m responsible for 10% and my insurance is responsible for 90%, but this requires a more expensive plan.

What is a copay? A copay (short for co-payment) is a set rate you pay for doctor visits, prescriptions, and other types of care after you’ve paid your deductible. For example, it is common to have a copay for something like regular Primary Care Physician (PCP) visits and a set amount for specialist visits. Copays are for PCP visits are less than copays for specialists.

Let’s say you choose a PPO insurance plan.

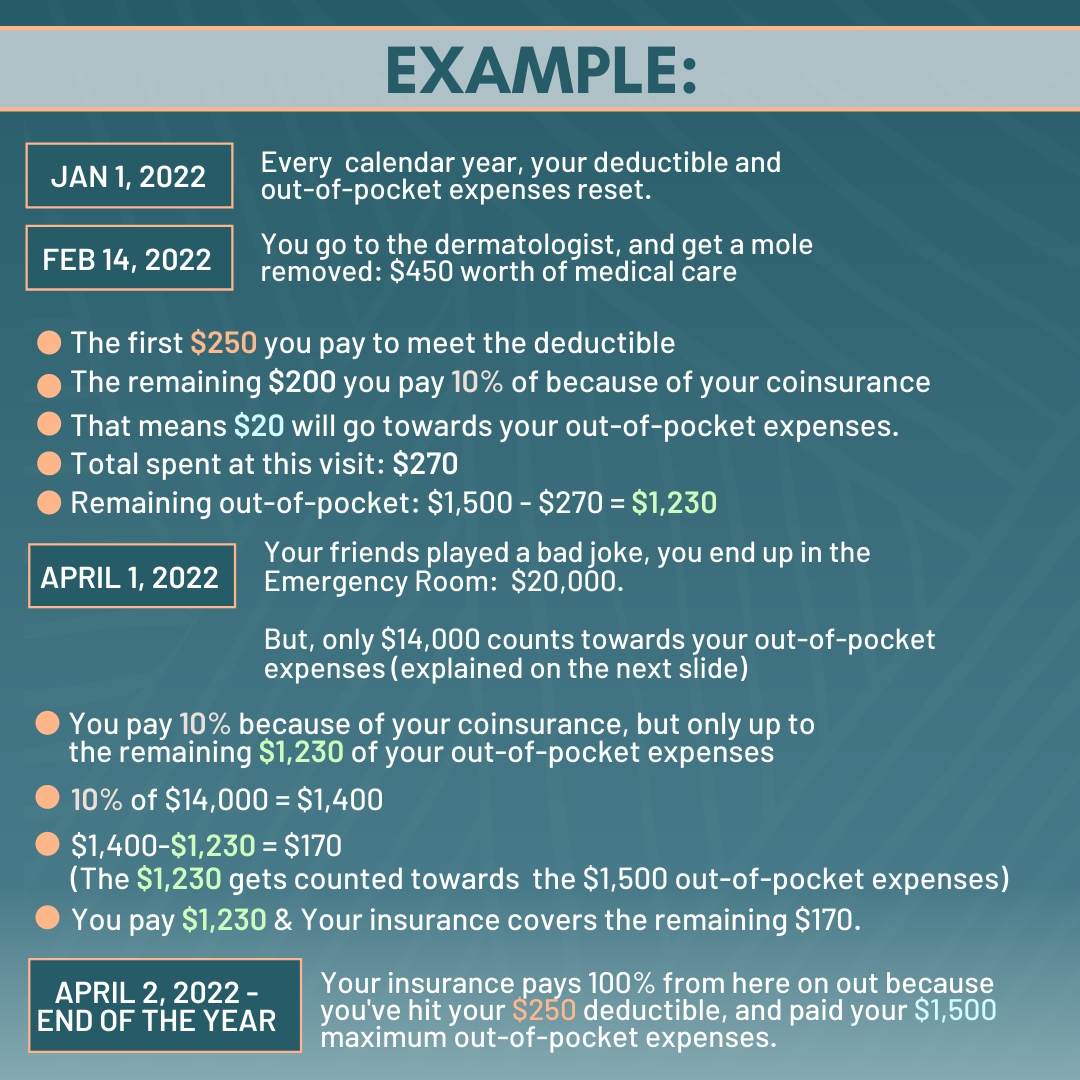

How do deductibles and out-of-pocket maximums work? The example below is based on a $250 deductible and $1,500 maximum out-of-pocket expenses. The coinsurance is 10%, meaning the insurance’s responsibility is 90%.

I realize HMO and EPO plans are structured differently as far as deductibles, copays, coinsurance, etc. But, because I have only ever had a PPO, I chose to use my friend’s PPO plan offered to her as an example.

PPOs are the most expensive (highest premiums), but also the most flexible, and should you be in any health emergency I guarantee that you would hope you were on a PPO plan.

EXAMPLE:

Looking at the example, you may be wondering for the $20,000 April Fool’s joke gone wrong emergency, why only $14,000 counts towards your out-of-pocket expenses and not all $20,000.

The out-of-pocket expenses amount ($1,500) you are trying to hit, are the ELIGIBLE health expenses covered by your plan. The whole amount is not always covered, just the APPROVED amount.

Example: You go to the Emergency Room and X-rays, blood labs, and care are all eligible expenses under your plan. The hospital then bills your insurance $20,000.

You’ll then receive an Explanation of Benefits for that visit from insurance. On your Explanation of Benefits, it will show the limit “allowable” for that service as being only $14,000 (could be more or less).

So the 10% coinsurance of that $14,000 is what will get applied to your deductible. That means $6,000 did not get accounted for and the hospital takes it as a write off.

Looking over your Explanation of Benefits is incredibly important.

This is where understanding your health insurance can help you save money. 80% of my Explanation of Benefits were calculated incorrectly! A majority of medical bills are incorrect, this is not uncommon. Can you imagine how much more money I would have paid out of my own pocket by not understanding my own insurance when I had 35+ ER visits, over 180 specialist visits, and countless treatments? A lot more $$$.

If you can understand this example above and ask questions to your health insurance provider, you can likely save thousands of dollars.

I want to add: I understand that not everyone can afford a PPO plan.

With HMOs and EPOs, you will have more affordable premiums, but out-of-pocket you could pay more for healthcare expenses and emergencies. For someone who is healthy and has not had many health emergencies, it seems more common to choose an HMO plan or an EPO plan to save money each month.

Obviously, that is a risk you would have to be willing to take for yourself. Because I can guarantee that if something terrible happens with your health, a PPO would be ideal. However, I understand that PPOs are typically much more expensive and not within everyone’s budget, and sometimes not even offered at your place of employment.

It’s simply something to consider for you to make the best decision for yourself. When I was much younger, I didn’t know anything about health insurance. However, my Mom always told me to choose a PPO because choosing your doctor when going through health issues, is very important. I’m glad I listened to her. When I least expected it, shit hit the fan with my health and the doctors who supported me and cared for me were only available on my PPO plans offered.

Another reason I love PPOs is because I can go see any doctor I want. I don’t have to see a Primary Care doctor first. I can go straight to a specialist of my choosing. Coming from someone who’s been through the wringer with health, I can promise you, you will want to have this flexibility if anything bad happens to your health.

The system itself is basically set up to give you anxiety, a pulsing migraine, and high blood pressure. Isn’t that ironic?

I hope this helps you understand more when it comes to choosing your healthcare plan for 2022. Don’t let it be a simple, quick decision. Your health is worth so much more than that.

This message was approved by a Benefit Manager, Human Resource Manager, and my own Healthcare Provider. Thanks Trisha from BlueShield of California.

Thank you for powering through 💪🏼